How is break pay calculated?

FieldClock will happily calculate paid breaks for you. For each job type, FieldClock determines the effective hourly rate for each employee and pays any paid break time at that effective hourly rate.

All types of jobs

Break pay is the same as their effective hourly rate. To see how hourly rate is calculated, see the "How are Payouts Calculated?" help article.

What if I want to give more breaks than required?

If you have automatic piecework break pay configured, FieldClock will treat the automatic amount of pay as the minimum time that should be paid for a specific non-productive time category.

Here are a few example scenarios based on the following configuration:

- If your crew boss assigned 10 minutes of "Break" time, and your employees worked for 8 hours (480 minutes), 10 minutes of "Break" time would be generated automatically.

- If your crew boss assigned 20 minutes of "Break" time, and your employees worked for 7 hours (420 minutes), your employees would still receive 20 minutes of "Break" time. (FieldClock will not reduce manually-assigned time, even if it's more than your Wage Program requires.)**

- If your crew boss assigned 20 minutes of "Travel" time, and your employees worked for 8 hours (480 minutes), 20 minutes of "Break" time would be generated automatically. (FieldClock ignores other non-productive time categories and only checks for the category you specify in your Wage Program when calculating automatic break pay.)

** Please note that prior to Feb 7, 2018, automatic break pay calculations would set total break time for piecework jobs according to your account's configuration. Starting on February 7, FieldClock will no longer reduce break payout times even if they exceed the amount specified in the automatic break pay configuration.

Calculating Regular Rate of Pay

Some locales have special rules for how piecework break pay must be calculated. For example, in Washington State, the break pay gets paid at the "regular rate of pay" over the course of a workweek. This means that break pay calculated when a job is finalized may not be the accurate pay rate for the related workweek.

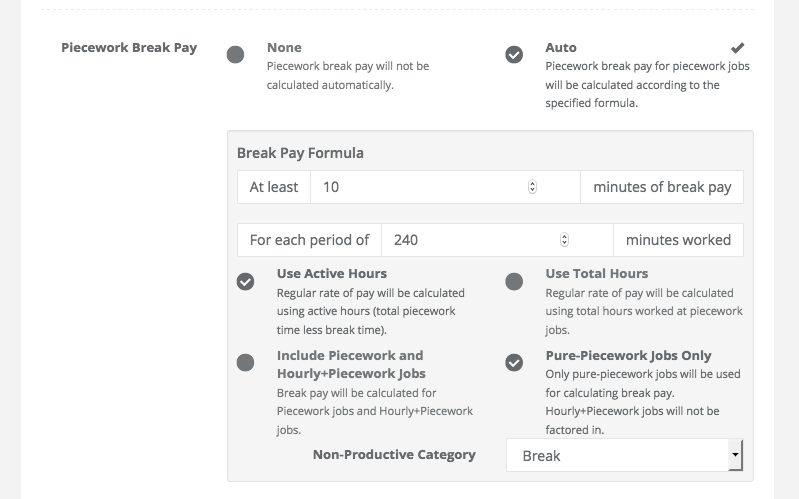

In this situation, you can configure your wage program to automatically calculate break pay according to the rules you specify. Continuing with the Washington example, you could configure break pay to pay 10 minutes of break pay for every 4 hour block of time worked, and to calculate the regular rate of pay using total piecework pay divided by the total active hours worked in the workweek by the employee.

When automatic break pay calculation is configured, any existing break payouts that were generated for piecework jobs will be deleted and replaced by the automatically calculated breaks. For this reason, you can safely record breaks during each job and know that the actual rate of pay will be calculated according to the formula you configure.

For FieldClock's purposes, the "workweek" is defined as the dates you include in your payroll batch. If you must calculate the regular rate of pay according to a calendar week, you should generate a separate payroll batch for each calendar week.

Choosing job types for automatic break pay

Depending on your locality, you may need to include different types of jobs when calculating break pay. If you need to include jobs where you pay a piece rate in addition to a base hourly rate, select "Include Piecework and Hourly+Piecework Jobs". If you only need to calculate break pay for pure-piecework jobs, select "Pure-Piecework Jobs Only".

Exporting or not exporting break data

When configuring your payroll nntipy, you may see an option to "omit break payouts". When you enable this option, FieldClock will not include break payouts with other payroll data. You may wish to use this option if you use a payroll system designed for agriculture that handles break pay calculations for you.

Note

Please keep in mind that FieldClock is intended to be used in many locales and with many payroll systems and for this reason we do not force or recommend any specific configurations upon our users. If you are unsure about how to configure the automatic break pay calculations for your local regulations, we recommend you seek guidance from a labor attorney specializing in your field.